1. Introduction

The Financial Transactions ERP project is designed to manage, monitor, and automate the financial operations of an organization. It helps maintain accurate financial records, track transactions, reconcile accounts, and generate financial reports such as journals, vouchers, and ledgers. This document provides an overview of the ERP Financial Transactions modules so that we can understand how the system is structured and how it supports business operations.

2. Technology Stack

Frontend: ASP.NET WebForms (C#) (ASCX, ASCX.CS, Design files, JavaScript)

Backend: BAL (Business Access Layer), DAL (Data Access Layer), Factory classes

Database: Microsoft SQL Server

3. Modules

3.1 Administration

The Administration module is used to define the organizational setup and manage core information such as company details, user accounts, and branch/department information. This ensures that all financial transactions are linked to structured organizational data.

3.2 Security Management

This module ensures that users can only access what they are permitted to. Roles are defined to control permissions, users are created and assigned to branches, and branch assignments help segregate access across multiple business units. It maintains data security and role-based access control.

3.3 Master Setup

3.3.1 General Setup

This module includes sub-modules for managing branches, partners, and user password changes, ensuring structured organizational setup, partner management, and secure access through password updates.

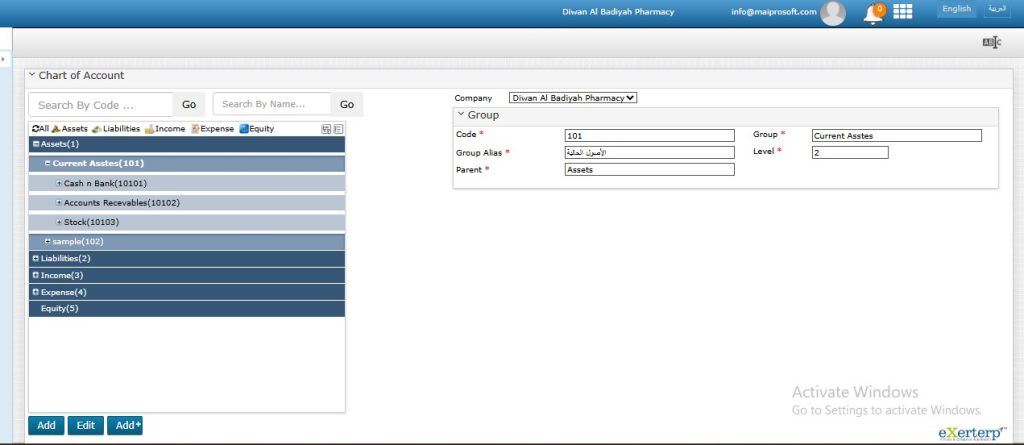

3.3.2 Financial

The Master Setup module comprises sub-modules for organizing and managing financial and operational structures. Divisions and Cost Centers define business units and track expenses, while Banks and Bank Account Mappings manage financial institutions and their accounts. Indicators help monitor performance, and Segments with Segmentations allow detailed, segment-wise financial reporting. Additionally, Payment Means configure various payment methods, including cash, bank transfers, credit/debit cards, and digital wallets, ensuring smooth transaction processing.

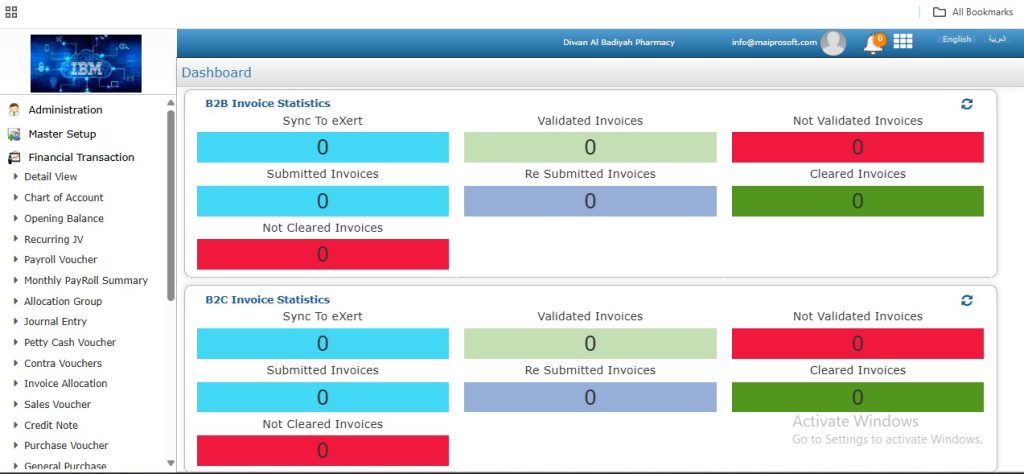

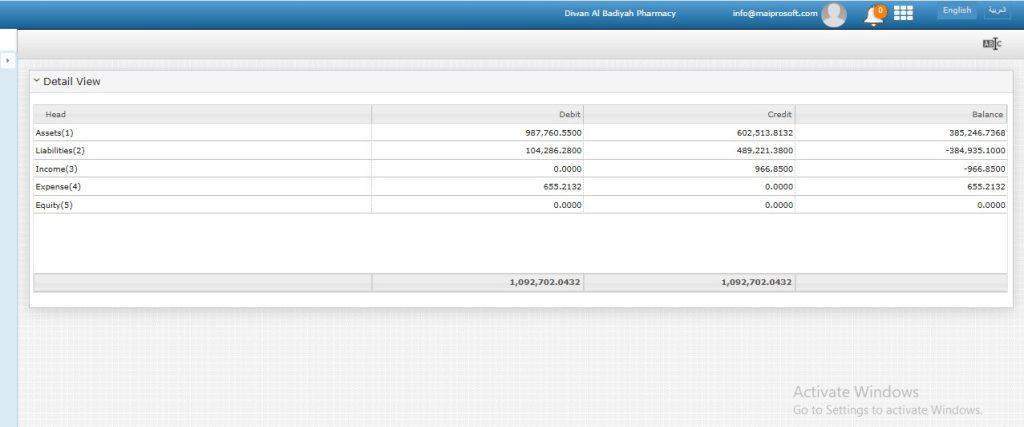

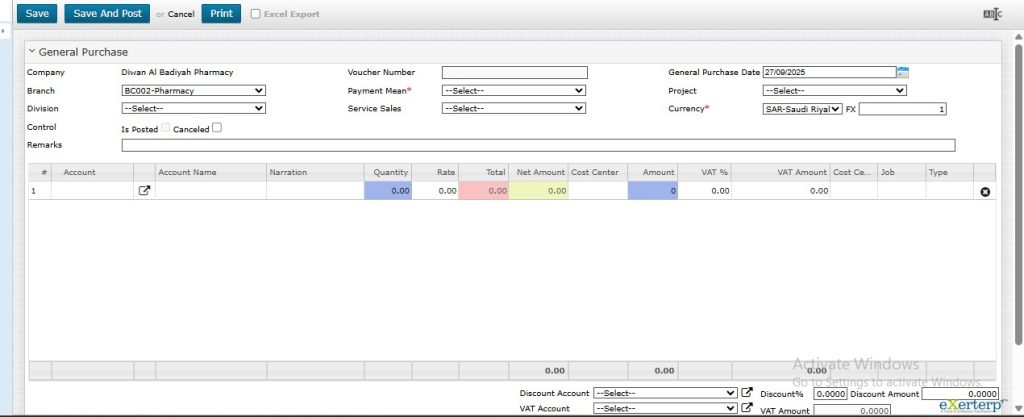

3.4 Financial Transactions

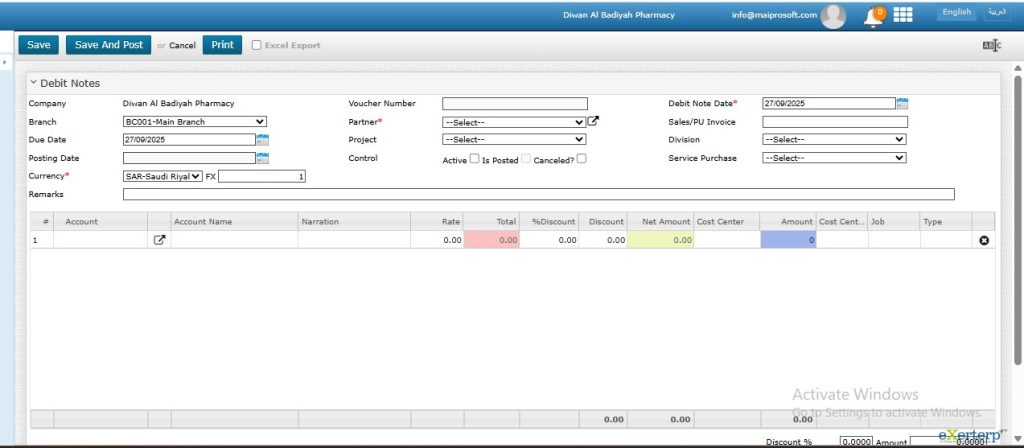

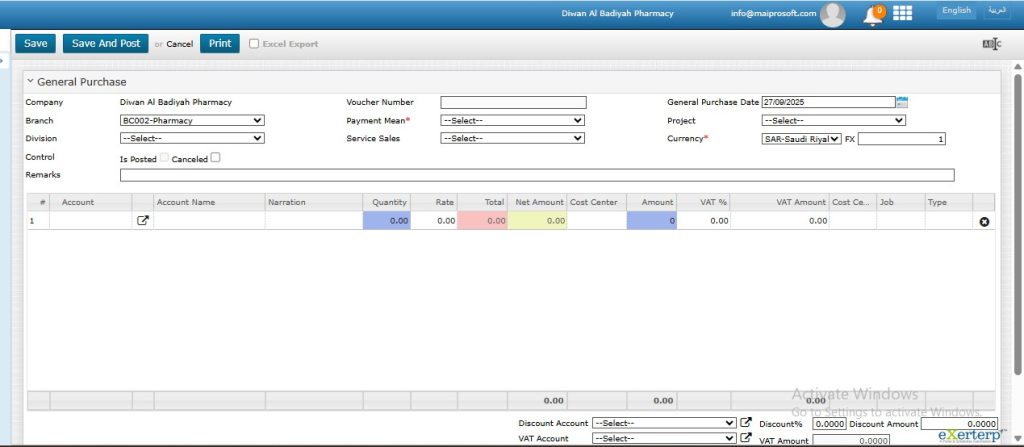

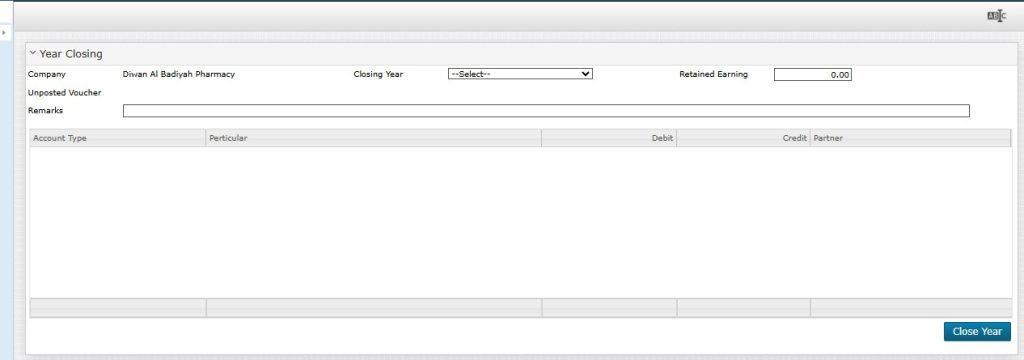

The Financial Transactions module is the core of the system, handling all monetary activities. It enables recording and viewing detailed transactions for each account, including journal entries, vouchers, and ledger updates. The module supports automating periodic journal entries through recurring journal vouchers, managing employee salaries and related deductions via payroll vouchers, and handling allocations across different accounts or cost centers using allocation groups. It also allows recording and tracking of both manual and automated journal entries, managing small cash disbursements through petty cash vouchers, and processing internal fund transfers with contra vouchers. Invoice payments can be applied to their respective accounts using invoice allocation, while sales transactions and revenue recognition are handled through sales vouchers. Credit adjustments against invoices are managed with credit notes, supplier invoices and purchases with purchase vouchers, miscellaneous purchases outside standard vouchers with general purchase, miscellaneous sales outside standard invoices with general sales, and debits applied to customer accounts with debit notes.

These processes ensure that all financial activities are accurately tracked, controlled, and aligned with organizational policies.

Why This ERP Financial Transactions System

- This ERP Financial Transactions System provides end-to-end control over all financial operations, from transaction entry to reconciliation and reporting. It maintains accurate account, segment, and branch records while enhancing security through user roles and access control. Built using industry-standard technologies such as ASP.NET WebForms and SQL Server, it ensures scalability and reliability. It also supports automated recurring entries, segment-wise tracking, and structured reports for decision-making.

5. What You Will Learn After Doing This Project

By working on this project, you will gain an understanding of how financial processes operate in real organizations and how ERP systems are structured into modules and sub-modules. You will learn to build enterprise financial applications using ASP.NET WebForms and SQL Server, implement role-based security, and manage transactions such as vouchers, journal entries, allocations, payments, and reconciliations. Additionally, you will understand how to implement segment-wise reporting and payment means management for accurate financial tracking.